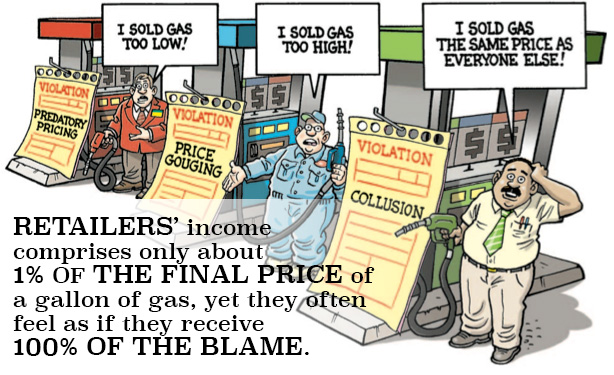

Retailers’ income comprises only about 1% of the final price of a gallon of gas, yet they often feel as if they receive 100% of the blame.

Retailers’ income comprises only about 1% of the final price of a gallon of gas, yet they often feel as if they receive 100% of the blame.

We are the only industry that has a price sign that is big and bold for everyone to see. Not only do our customers, the consumers, see this sign, but our competitors do as well.

More than 97 percent of the nation’s convenience stores selling gasoline are owned or operated by independent companies that rely on sales in their store to run their business. Convenience store retailers dislike high gas prices as much as their customers do. When wholesale gas prices increase, they must fight to attract price-sensitive customers, often at the expense of profits, and watch their already slim gas margins decline while their credit card costs go up.

Retailers Are Not “Big Oil”

Most stations sell branded gas, but they are not owned and operated by major oil companies. In fact, 56 percent of convenience stores selling gas are one-store operators, true Mom & Pop operations. It is estimated that only two percent of the convenience stores selling gas are owned and operated by a major oil company.

Retailers Make Very Little Selling Gas

Generally, the mark-up (or “margin”) on a gallon of gas is about 15 cents per gallon (gross profit before expenses). Factoring in expenses, which include rent, utilities, freight, labor and credit card fees, a retailer is left with about two to three cents per gallon in profit. Stores sell anaverage of 4,000 gallons per day, so retailers typically make about $100 per day selling gas (net profit available to pay other costs not previously referenced such

as maintenance and insurance).

Margins can vary wildly throughout the year. When wholesale prices climb, retailers typically hold back price increases, knowing that price-sensitive customers will go somewhere else to buy their fuel – and other items inside the store. This often leads to a situation where retailers will lose money on every gallon they sell. When wholesale prices fall, retailers seek to extend margins to compensate for lost margins when prices were rising.

Today, retailers cannot run their business on gas sales alone. While 68 percent of a typical store’s sales dollars in 2011 came from selling gas, only

27 percent of their profit dollars came from fuel.

Quite simply, they have two tough choices, either keep gas margins at traditional levels and know they will lose customers if they are priced

higher than the competition, or eat margins to keep gas customers (and in-store customers there are no in-store customers.

Gasoline Pricing: A No-Win Situation

OMEGA Press

- WV Oil Marketer & Grocers Association Campaign Raises Over $154,000 For Children in Need of Assistance

- Thank You for Making the 2024 Jan Vineyard Charity Golf Outing a Success!

- Join the GameChanger July Campaign: Empower Our Youth, Prevent Substance Misuse

- WV Oil Marketer & Grocers Association Campaign Raises Over $137,000 For Children in Need of Assistance

- WV Oil Marketer & Grocers Association Campaign Raises Over $132,000 For Children in Need of Assistance

NGA News

- NGA Announces 2026 Creative Choice Awards Winners

- ShopRite To Open New Supermarket Feb. 4 In Manahawkin, NJ

- National Grocers Association Calls on FTC and DOJ to Act Against Abusive Buyer Power Driving Higher Food Prices

- NGA Calls for Swift Passage of Credit Card Competition Act to Lower Costs for Grocers and Consumers

- National Grocers Association Applauds Call for Stronger Antitrust Enforcement to Level Playing Field for Independent Grocers, Address Affordability for American Consumers

CSP Fuel News

- H&S Energy’s longtime CFO Moe Haris resigns

- Casey's senior vice president of prepared food and dispensed beverages among Silver Plate winners

- Robot-run convenience store VenHub begins trading on Nasdaq

- GLP-1 lawsuits over side effects are growing

- Generational shifts in wellness redefine consumer behavior