Dear Governor Justice,

I'm writing to you on behalf of the West Virginia Oil Marketers and Grocers Association (OMEGA WV) in regards to the upcoming Special Session and budget.

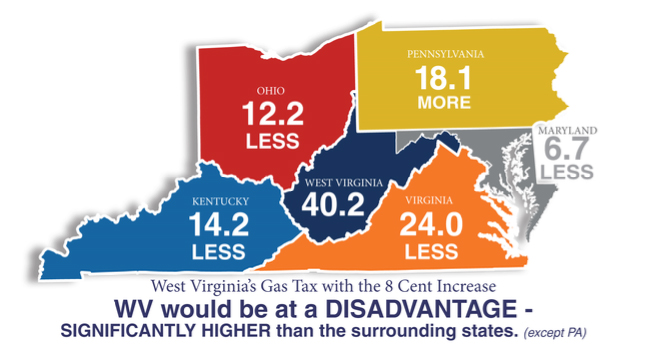

For our industry, border stability is our number one issue. Because of the products we sell – gasoline, tobacco, sugary drinks, etc. – we must remain competitive on our borders. Unfortunately, it appears as if our industry has been under constant attack with tax increases proposed throughout the session on all of these items.

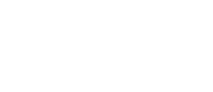

The proposed eight cent increase in the gas tax (flat and variable) would make ours significantly higher than all our border states except Pennsylvania.

For reference, I’d like to give you an idea of what the recent tobacco tax did to our border retailers. For border locations, overall tobacco sales were down a minimum of 15% (Huntington), 24% (Princeton), 22.5% (Wheeling) and 24% (Martinsburg).

Gasoline purchases account for approximately 5% of consumer spending in any given year. This increase would also place a huge burden on the citizens of West Virginia who choose to purchase inside our state.

The creation of the Commercial Activities Tax (CAT) would hit our industry especially hard because our businesses are high gross sales with low net margins. Normally, when the price increases our margins decrease. If it becomes a necessity to implement this tax, we request that fuel be exempt.

As mentioned above, our industry provides many products to our citizens and any tax increases will greatly affect our businesses and possibly reduce the number of jobs that we are able to provide to our citizens because of loss of border sales.

Below are graphs showing our current tax rates compared to our neighboring states:

Thank you in advance for your consideration. If you would like to discuss, please do not hesitate to call me at 304.343.5500.

Sincerely,

Janet S. Vineyard

President